I’m starting Robert Caro’s The Power Broker: Robert Moses and the Fall of New York. I will probably share some notes or thoughts, but I’m actually trying it as an audiobook (there’s no ebook! What was I supposed to do?) so my usual e-annotation method won’t quite work. I’ll work out how I’ll write to it.

—

I did not think that writing about my own finances would be as uncomfortable to me as it was. Anyway.

Earlier this year, on one of the many weeks when I broke my promise to write a blog post here, I became debt free. It was a tiny milestone on my personal (and quite boring, I admit) hike towards Financial Independence. I was never in any financial danger, but I was a student not too long ago, and though I had grants and scholarships and even graduated early I still managed to get stuck with a mound of student debt.

At first I did little about it. For most of my employed life I was more focused on investment than in debt reduction. I figured that the same dollar could give a higher ROI in stocks than it would reducing my debt. I had spreadsheets! I paid the minimum amount on my student debt each month.

Last year, though, my approach to this debt changed. I reasoned that hitting zero on my student debt was an achievable and measurable goal in startlingly little time (with some discipline), and more importantly I felt that goal would be a great launchpad to build habits I wanted to build anyway. The student loan amounts individually were small enough that I could tackle each one individually and get a dopamine rush out of zeroing them out in a reasonable amount of time. As a result of my approach, I tackled smaller debt loads first to try to build a habit and keep the game going, instead of the strict Jedi-rationalist approach of attacking larger higher-interest debts and risking those long struggles pushing me off the wagon.

Once I got into it, I found ways to marshal together a bit more money to accelerate the rate that I hit my targets. Due to the aggression that the game instilled in me, I achieved the goal significantly earlier than I projected. My daily expenses were leaned out noticeably but at no major sacrifice; I still paid for trips, including a vacation in Iceland, and I still donated at the same rate that I always have.

Now that the game’s been won, I can muster those forces towards investments with equal intensity.

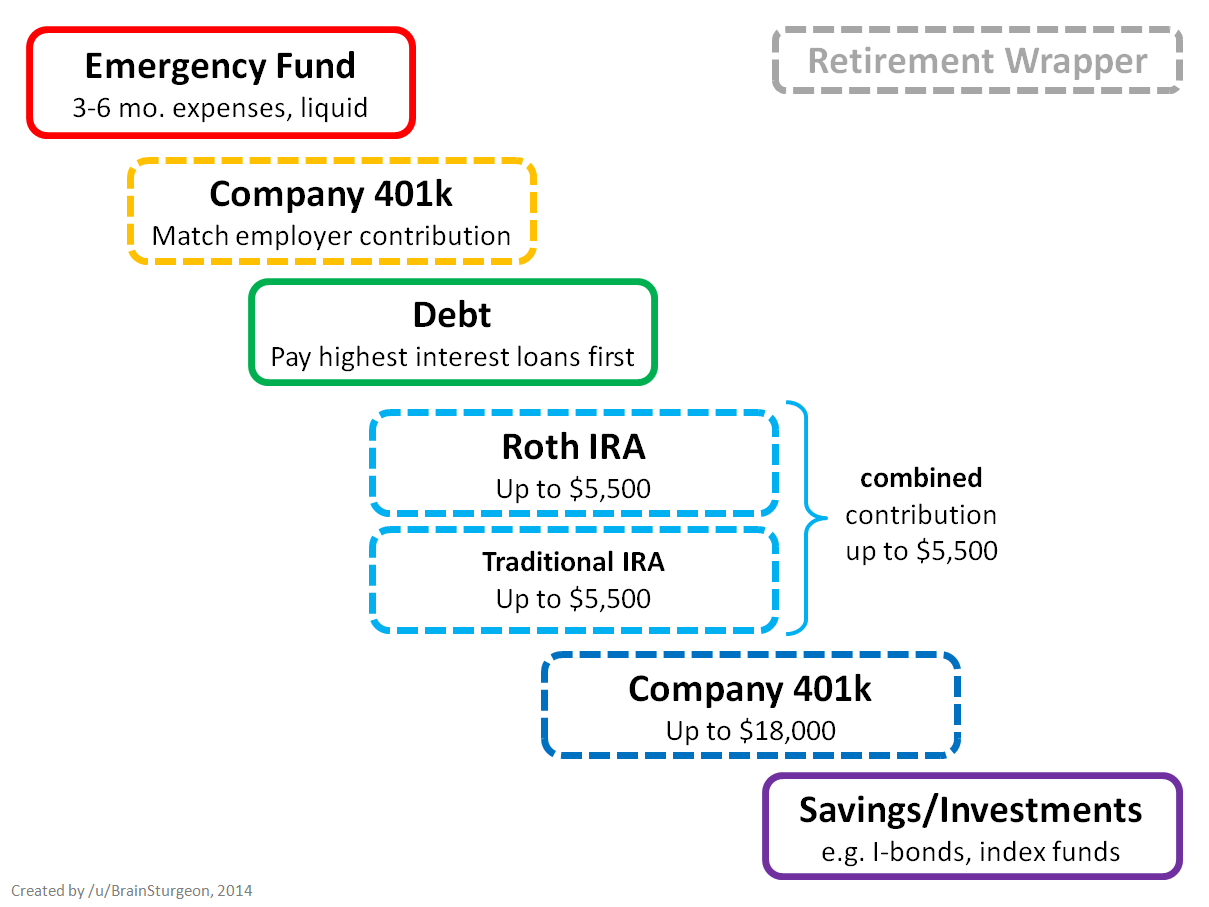

For what it’s worth, I find this “Order of Operations” to be a great heuristic for how to build:

There are whole communities of people, there are gurus and subreddits and podcasts on Financial Independence- I’d recommend for anyone to take a look. I think it’s an especially worthy goal because I don’t know what 2019Me wants to be when he grows up, or what 2026Me will value, but I do know that by achieving (or even just approaching) this goal of Financial Independence I improve his optionality significantly. And it can feel good to have a measurable goal, to project out futures and then to act to achieve them.

Other caveats: I have no children and few real financial obligations so far. My SO has been supportive and is even looking into adapting with me. I knew these things before, but discussing my ambitions and sharing my victories with friends has made me appreciate the social context that buoys me that much more.